California Gas Tax Rip-Off

California Gas Tax Rip-Off

Yesterday I put some premium gas in my bike and it cost me $4.19 a gallon! Yes, riding a motorcycle, we usually only get a couple of gallons of gas at a time, but here in California, once again our gas prices have gone crazy.

Just in the last two weeks gas prices have gone up over $.43 a gallon. Sure, there are external factors that affect the gas price in general, but if you live in California you’re always getting screwed on the gas price. Years ago, I used to remember seeing at the side of the gas pumps the stickers that said how much the gas was and how much all the different taxes are, I haven’t seen that lately here in California. Now, maybe I just haven’t been paying close attention or perhaps the politicians, to keep the public in the dark, have eliminated that rule that you had to have a sticker showing the taxes on the gas price.

California Gas Tax Rip-Off

Sure, usually we just like to get on our bikes and ride and forget about all the external bullshit. The problem is, if we don’t take an active part in our own states politics, we end up getting screwed.

For those of you who may not know, about two years ago California gas tax was increased, as well as a registration and DMV fees. At that time, the gas tax in California went up by $.12 a gallon. Just this July, the anniversary for this gas tax increase, the tax went up an additional six cents a gallon. So, in just two years, Californians have seen their gas tax increase by $.18 a gallon! Keep in mind, this is on top of our already super high gas taxes. This new gas tax is set to increase every year in July. Oh, guess what, it can only go up it can never go down!

Also here in California, the vast majority of the populace does not realize that there are also some hidden state taxes for each gallon of gas. Yes, here in California there is a state excise tax that adds $.473. On top of that, the state imposes a 2.25 percent gasoline sales tax. In addition, California has adopted a low-carbon fuel standard and a cap-and-trade scheme for carbon emissions which together, increase the state’s gas prices by $.24 per gallon. These taxes are not seen by the general public because they are taxed when the gas is produced at the refinery level. Lastly, California has special blend gasoline that our neighboring states do not have. These special latte blends of gas do not allow any competition from gas refineries outside of California because it would be very costly for them for them to switch over to these blends just for the California motorist. So, the poor California motorist is stuck in a semi-non competition environment.

We do have 15 gasoline refineries, but, really, only three of them produce over 200,000 barrels of gas per day. With California’s population increasing, the last new gas refinery built here was in 1977 . . . Yes, that’s 42 years ago!

With only three major refineries, there’s not much competition and it seems that every year or so there is a major fire at one of these refineries that causes a spike hike in the gasoline price that last for weeks.

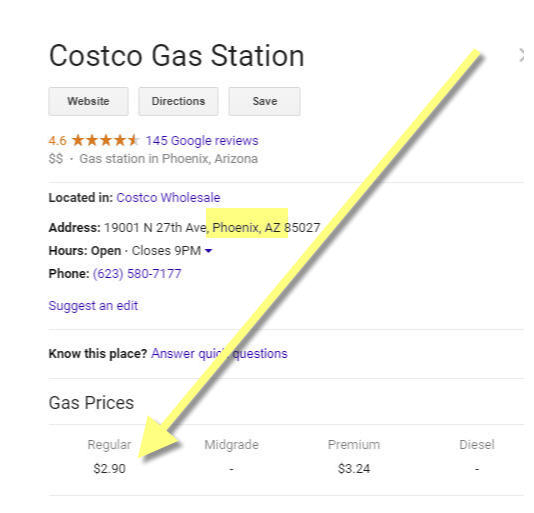

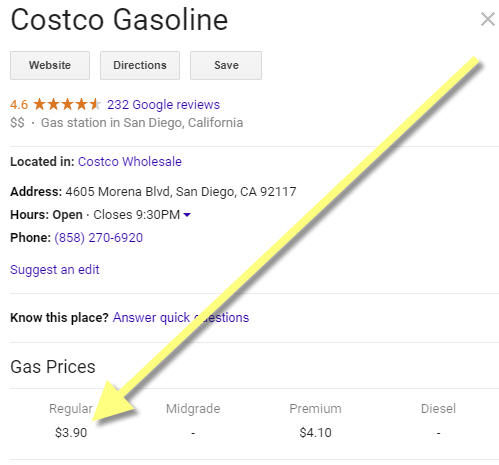

To compare apples to apples I took today’s Cosco regular gas price, here in San Diego, and compared it to the Cosco gas price in Phoenix Arizona. You can verify this for yourself with a simple Google search. But, basically as you can see, today the difference in the regular gas price was an even dollar per gallon!

++++++++++++++++++++

Think about this, every time you go to fill up here in California if you have a Ford F150 pickup truck (probably the most popular pickup truck in the US), it will cost you here in California $23 more in taxes, then filling up in Phoenix. Now, say you fill up twice a month, you will be paying $552 more in California then you would be in Phoenix. Please keep in mind I’m just talking about the price of gas. When we had our latest gas tax increase, California also jacked up the registration fees and other DMV fees as well.

In the 2018 elections, we had proposition six to rollback the new gasoline tax and increased DMV fees. I believe, in initial polling this proposition was leading by 60 something percent. But, the California Atty. Gen. has the power to title all propositions. So, when the original title was rollback the new gasoline taxes and increased DMV fees, the Atty. Gen. changed it and it ended up being “Eliminates certain road repair and transportation funding. Requires certain fuel taxes and vehicle fees to be approved by the electorate. Initiative constitutional amendment.” Since, unfortunately, most of the population of California don’t take the time to read all the propositions in their entirety, they just look at the headline. So, by changing this headline, combined with advertising basically designed to scare voters, by saying there won’t be funds necessary to repair the roads or bridges which will damage their cars and safety, sadly this proposition failed.

Before this latest gas tax hike and DMV fee increases, you have to ask yourself where were our already high gas tax going? It is said, that just about 20% of the original gas tax was going to maintaining our roads and bridges. The other 80% was going into the California general fund. Which means, motorist were paying for our many bloated government salaries and outrageous pension plans by having the state siphon off this gas tax money.

I know I’ll probably get comments saying the way to go is all electric cars/bikes. But, not so fast, because California does have high electricity prices compared to the rest of the country, and within the state, SDG&E charges more than California’s two other investor-owned utilities — Southern California Edison and Pacific Gas & Electric.

California has the highest electric rates in the continental US, 50% higher than the US average. And electric rates in those states just keep increasing. So, recharging your California car is much more expensive.

From Politico (certainly not a right-leaning publication), on electric vehicles: “But there is no economic or environmental justification for the many billions of dollars in subsidies that America is already paying to speed their adoption”.

I hate to end this article with what seems like a hopeless situation. So, please look at the La Jolla doctor’s proposition to recall Gov. Newsom. Although this is not directly related to the gas tax I think if we succeed (it’s happened before with Gray Davis) it will send a powerful message to the politicians in Sacramento that were tired of being taxed and screwed over to fund their liberal agenda.

*******

If you are into custom factory choppers or always wanted a cool chopper, check out the 2008 Big Dog k9 beauty!